Knowledge hub

Learn More About Investing in UAE

Real Estate Market Insights and Trends in the UAE

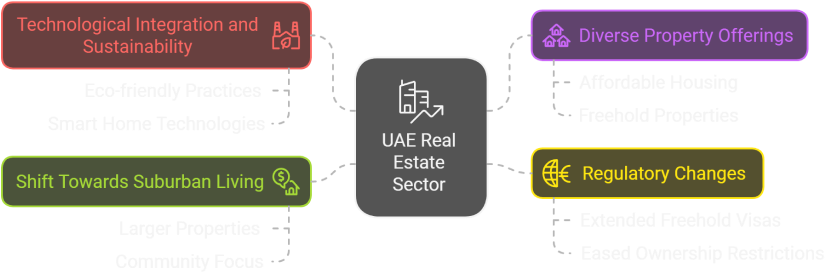

The real estate market in the United Arab Emirates (UAE) continues to demonstrate robust growth and flexibility in response to global economic shifts and evolving consumer preferences. The market is showing strong signs of recovery from the post-pandemic downturn, with Dubai and Abu Dhabi leading the way in market activity and property development.

Key Trends and Developments

1Technological Integration and Sustainability

New developments increasingly incorporate eco-friendly practices and smart home technologies. Emphasis on sustainability and innovation is evident in many new projects.

2Technological Integration and Sustainability

New developments increasingly incorporate eco-friendly practices and smart home technologies. Emphasis on sustainability and innovation is evident in many new projects.

3 Technological Integration and Sustainability

New developments increasingly incorporate eco-friendly practices and smart home technologies. Emphasis on sustainability and innovation is evident in many new projects.

4 Technological Integration and Sustainability

New developments increasingly incorporate eco-friendly practices and smart home technologies. Emphasis on sustainability and innovation is evident in many new projects.

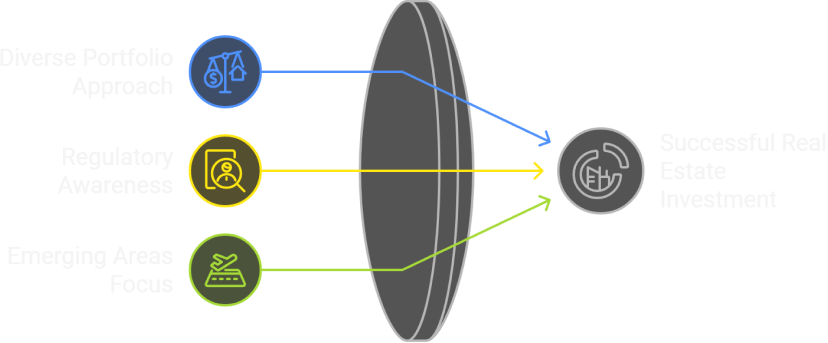

Investment Strategies

Dubai’s real estate market, with its wide array of housing options, commitment to sustainability, and inclusivity of diverse financial capacities, continues to attract investors and residents alike.

Prospects for Future Growth and Outlook in Dubai’s

Real Estate Market

Dubai’s real estate market is poised for significant growth, driven by progressive regulations and its status as a global business and tourism hub. Several factors contribute to the optimistic outlook for UAE properties, particularly in Dubai.

Progressive Regulations

Easing of foreign ownership regulations and the introduction of long-term visas for investors are expected to attract more foreign capital.

Global Business and Tourism Hub

Dubai’s strategic position as a major international business and tourism center enhances its real estate market’s attractiveness.

Sustainable and Smart Developments

Emphasis on modern, eco-friendly projects aims to transform Dubai into a smart and sustainable city, appealing to a growing segment of environmentally conscious buyers and investors

Impact of Expo 2020

Infrastructure Improvements

Preparation for Mega Events

Progressive Regulations

Easing of foreign ownership regulations and the introduction of long-term visas for investors are expected to attract more foreign capital.

Global Business and Tourism Hub

Dubai’s strategic position as a major international business and tourism center enhances its real estate market’s attractiveness.

Sustainable and Smart Developments

Emphasis on modern, eco-friendly projects aims to transform Dubai into a smart and sustainable city, appealing to a growing segment of environmentally conscious buyers and investors

Impact of Expo 2020

Infrastructure Improvements

Preparation for Mega Events

Market Report

Executive Summary

The Dubai real estate market continues to be a beacon of growth and resilience, as evidenced by the impressive performance metrics recorded in May 2024. With a significant surge in both transaction volume and sales value, the market is clearly on an upward trajectory, showcasing its robust health and attractiveness to investors. This detailed report delves into the various facets of the market’s performance over the month, providing a comprehensive analysis of total transactions, average property prices, and top-performing areas. Additionally, it explores the distribution of property sales across different price ranges, offering insights into the diverse market segments that make up Dubai’s vibrant real estate landscape

In May 2024, the Dubai real estate market experienced a significant boost in activity, reflecting a robust and growing market. This report provides an in-depth analysis of the total transactions, sales value, average property prices, top-performing areas, and sales volume by price range for the month.

Total Transactions and Sales Value

May 2024

17,539

Total Transaction

+49.2% vs May 2023

AED 45.8B

Total Transaction

+33.8% vs May 2023

15.535

Apartments & Villa

549

Commercial Units

1.455

Plots

Breakdown by Property Type

May 2024

Apartments and Villas

% of Total Transactions: Approximately 88.6

Commercial Units

% of Total Transactions: Approximately 3.1

Plots

% of Total Transactions: Approximately 8.3

Sales Value

Here’s an approximate breakdown by property type based on the total transactions

Apartments and Villas: AED 40.6 billion

(estimated based on their transaction

volume proportion).

(estimated based on their transaction

volume proportion).

(estimated based on their transaction

volume proportion).

AVERAGE PROPERTY PRICES

May 2024

Apartments

AED 1.3 Million

8.8% vs May 2023

Villas

AED 2.8 Million

10.09% vs May 2023

Commercial

AED 4.6 Million

49.2% vs May 2023

Plots

AED 1.5 Million

7,4% vs May 2023

Apartments

Average Price: AED 1.3 million

8.8% vs May 2023

Villas

Average Price: AED 2.8 million

10.9% vs May 2023

Significance: The significant rise in villa prices indicates a robust demand for more spacious and luxurious residential options. This trend highlights the growing preference for high-end living spaces in Dubai’s real estate market.

Commercial Units

Average Price: AED 1.5 million

49.2% vs May 2023

Plots

Average Price: AED 4.6 million

7.4% vs May 2023

Significance: Despite the overall market growth, the decrease in plot prices suggests a shift in investment focus or a temporary market correction. This trend may reflect varying demand dynamics or changes in development priorities

TOP 5 PERFORMING AREAS

May 2024

Al Barsha South Fourth

Transaction Value AED 1.521m | 1,547 Transaction.

Significance: Despite the overall market growth, the decrease in plot prices suggests a shift in investment focus or a temporary market correction. This trend may reflect varying demand dynamics or changes in development priorities

Mohammed Bin Rashed City

Transaction Value AED 1.193m | 1,173 Transaction.

Significance: Mohammed Bin Rashed City showcased substantial activity, reflecting its status as a prime location for property investments.

Ras Al Khor Industrial First

Transaction Value AED 2.443m | 1,119 Transaction.

Significance: The high transaction value in Ras Al Khor Industrial First demonstrates its significant market activity and attractiveness for investors.

Business Bay

Transaction Value AED 2.568m | 1,073 Transaction

Significance: Business Bay continues to be a key player in Dubai’s real estate market, with a robust transaction volume and value.

Dubai Marina

Transaction Value AED 3.409m | 851 Transaction.

Significance: Dubai Marina remains a highly sought-after area, with a notable transaction value and a significant number of transactions.

PROPERTY SALES VOLUME BY PRICE RANGE

Executive Summary

Below AED 1 Million: Properties priced below AED 1 million accounted for 29% of the total sales volume in May 2024, with a substantial 5,093 transactions. This price range attracts a diverse range of buyers, including first-time homebuyers, investors looking for affordable options, and individuals seeking entry-level properties in Dubai’s real estate market

AED 1 to 2 Million: The price range of AED 1 to 2 million saw the highest activity, accounting for 34% of total transactions with 5,876 transactions. This segment is popular among mid-range buyers and investors, offering a balance of affordability and quality, making it the most active price range in the market.

AED 2 to 3 Million: Properties priced between AED 2 to 3 million made up 18% of the total sales volume, amounting to 3,212 transactions. This range appeals to buyers seeking more spacious and luxurious properties, reflecting strong demand in the upper mid-range segment of the market.

AED 3 to 5 Million: The AED 3 to 5 million price range represented 11% of total transactions, with 1,992 transactions. Properties in this range attract higher-end buyers and investors looking for premium properties with superior amenities and prime locations.

More than AED 5 Million: Properties priced above AED 5 million accounted for 8% of total transactions, with 1,366 transactions recorded. This segment caters to the luxury market, drawing affluent buyers and investors interested in high-end, exclusive properties that offer top-tier amenities and prestigious addresses.

More than AED 5 Million: Properties priced above AED 5 million accounted for 8% of total transactions, with 1,366 transactions recorded. This segment caters to the luxury market, drawing affluent buyers and investors interested in high-end, exclusive properties that offer top-tier amenities and prestigious addresses.

Below AED 1 Million: Properties priced below AED 1 million accounted for 29% of the total sales volume in May 2024, with a substantial 5,093 transactions. This price range attracts a diverse range of buyers, including first-time homebuyers, investors looking for affordable options, and individuals seeking entry-level properties in Dubai’s real estate market

AED 1 to 2 Million: The price range of AED 1 to 2 million saw the highest activity, accounting for 34% of total transactions with 5,876 transactions. This segment is popular among mid-range buyers and investors, offering a balance of affordability and quality, making it the most active price range in the market.

AED 2 to 3 Million: Properties priced between AED 2 to 3 million made up 18% of the total sales volume, amounting to 3,212 transactions. This range appeals to buyers seeking more spacious and luxurious properties, reflecting strong demand in the upper mid-range segment of the market.

AED 3 to 5 Million: The AED 3 to 5 million price range represented 11% of total transactions, with 1,992 transactions. Properties in this range attract higher-end buyers and investors looking for premium properties with superior amenities and prime locations.

More than AED 5 Million: Properties priced above AED 5 million accounted for 8% of total transactions, with 1,366 transactions recorded. This segment caters to the luxury market, drawing affluent buyers and investors interested in high-end, exclusive properties that offer top-tier amenities and prestigious addresses.

More than AED 5 Million: Properties priced above AED 5 million accounted for 8% of total transactions, with 1,366 transactions recorded. This segment caters to the luxury market, drawing affluent buyers and investors interested in high-end, exclusive properties that offer top-tier amenities and prestigious addresses.

Key Insights and Market Trends

Executive Summary

Residential Market Strength

The residential market in Dubai showed resilience and strength in May 2024, with notable increases in average prices for apartments and villas. This trend indicates sustained demand and investor confidence in Dubai’s residential properties.

Commercial Property Demand

The commercial real estate sector experienced a surge in value, with a remarkable 49.2% increase in average prices for commercial units. This points to a growing demand for business spaces and investment opportunities in Dubai’s commercial sector.

Plots

The decrease in average prices for plots by 7.4% suggests a shift in investment focus or market dynamics. This trend may indicate changing preferences among investors or adjustments in development strategies within the real estate market.

Overall Market Health

Despite fluctuations in specific property types, the overall market remains healthy and appreciating, reflecting a balanced mix of affordability and high-end properties. This stability indicates a favorable environment for both buyers and investors in Dubai’s real estate market